The 2024 Foreign Trade Rules Reform (FTRR) introduces critical changes that directly affect businesses with VAT, IEPS, and OEA certifications. These updates aim to enhance control over foreign trade operations, requiring companies to adopt new systems and processes to ensure compliance. In this article, we’ll outline the key implications of these new reforms.

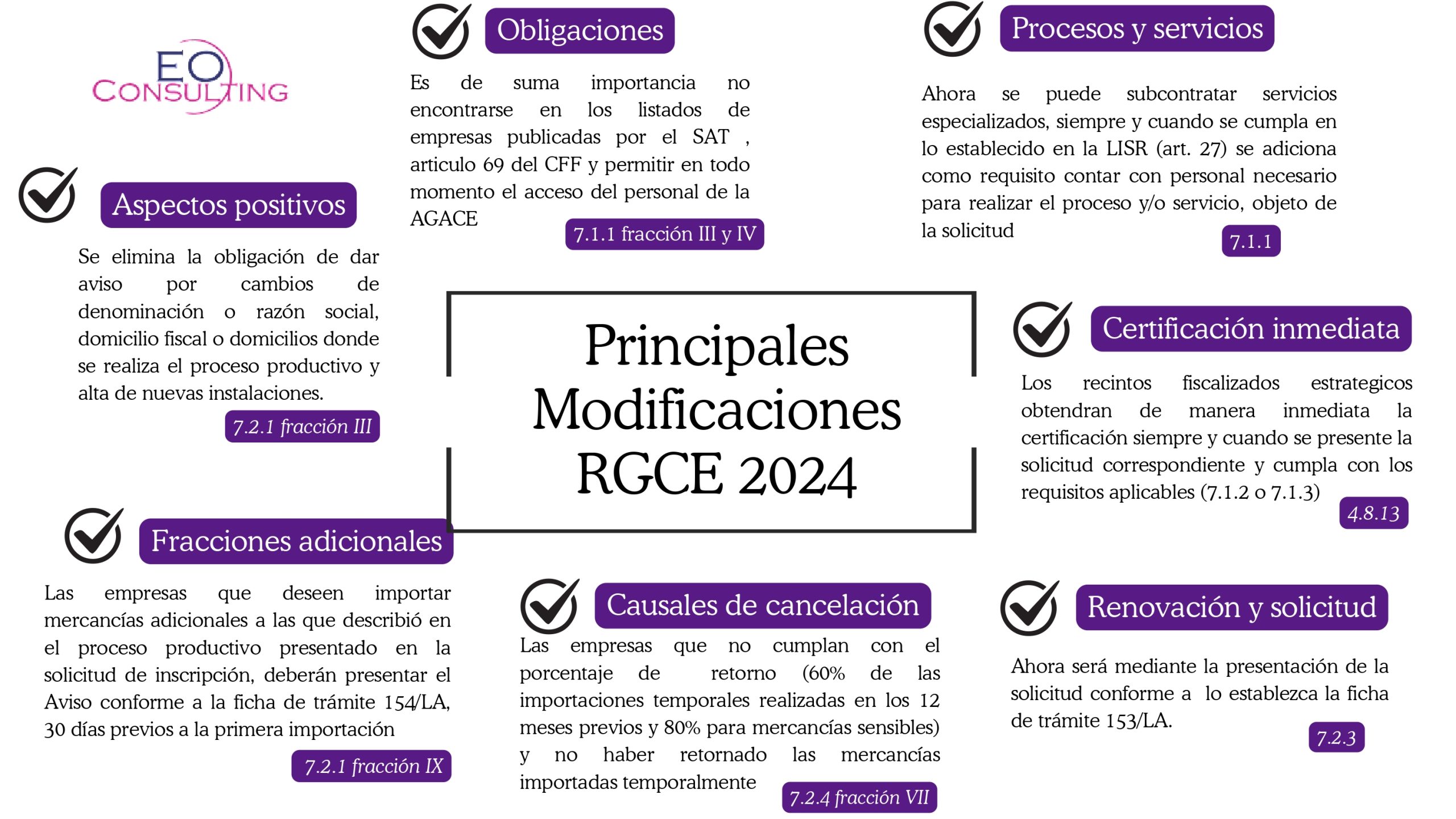

Key Changes in the 2024 FTRR

One of the most significant updates in the 2024 Foreign Trade Rules Reform is the implementation of an automated inventory control system. According to Annex 24, Section C, this system must adhere to the following critical points:

- Electronic Information Submission: The system must be configured to electronically transmit the required information to customs authorities within 48 hours of any inventory changes.

- Real-Time Access for Authorities: Customs authorities will have direct online access to the system through a username and password provided via an official written notice.

- Inventory Supervision: Authorities can review inventory balances, reports on entries and exits, and other relevant data directly through the automated system.

These changes aim to enhance transparency and control over inventory management for certified companies. Businesses must ensure their inventory data is accurate and accessible in real time to avoid discrepancies that could lead to penalties or delays in operations.

Additionally, the automated system simplifies audits for customs authorities, reducing the need for physical inspections and expediting the review of documents and inventory balances online.

Implications for VAT, IEPS, and OEA Certifications

The 2024 Foreign Trade Rules Reform directly impacts businesses with VAT, IEPS, and OEA certifications. Key implications include:

- Return Percentage Compliance:

Certified companies must meet minimum return percentages for temporarily imported goods. The reform mandates that:- At least 60% of temporarily imported goods must be returned within 12 months.

- This percentage rises to 80% for sensitive goods.

- Specialized Service Subcontracting:

Businesses subcontracting specialized services must comply with the Income Tax Law (LISR). This includes demonstrating the operational capacity and workforce required for the certification process, emphasizing internal operational capability. - Inventory System Access:

Companies must provide customs authorities with online access to their inventory control systems. This involves submitting a username and password via an official notice, allowing real-time supervision of goods movement, balances, and related reports.

3 Frequently Asked Questions About the 2024 Foreign Trade Rules Reform

These changes have raised numerous questions among certified companies. Below are answers to some of the most common concerns:

1. Why is the authority requesting a password to access my inventory system?

This measure aims to facilitate immediate access to inventory-related data, enabling real-time supervision. The 2024 Foreign Trade Rules Reform enhances transparency and simplifies audits, allowing customs authorities to verify compliance and prevent potential irregularities.

2. How will authorities access my inventory control system?

Authorities will remotely access your inventory system using the username and password you provide through an official notice submitted to the General Administration of Customs Audit (AGACE). This eliminates the need for on-site visits, as outlined in the reform.

3. How will the foreign trade rules reform affect my business and operations?

Non-compliance with the 2024 reform could result in the cancellation of VAT, IEPS, or OEA certifications, significantly impacting your foreign trade operations. Failure to meet return percentages or implement the automated inventory system within the specified timeframe could also lead to additional penalties.

4. What actions do I need to take regarding the new changes?

To comply with the 2024 reform, businesses should:

- Upgrade Inventory Control Systems: Implement an automated system that aligns with Annex 24 requirements, ensuring data is accessible online within 48 hours of any changes.

- Meet Return Percentages: Ensure at least 60% of temporary imports (80% for sensitive goods) are returned within 12 months.

- Maintain Proper Documentation: Submit the necessary notices to AGACE, including the username and password for automated systems.

Opportunities and Benefits of Complying with the 2024 Reform

Despite its challenges, the 2024 Foreign Trade Rules Reform presents opportunities for certified companies. Implementing an automated inventory control system not only ensures compliance but also optimizes internal processes.

A more efficient and transparent system can improve inventory management, reduce errors, and streamline audits and reviews by customs authorities.

The changes introduced in the 2024 Foreign Trade Rules Reform are substantial, particularly for VAT, IEPS, and OEA-certified businesses. Implementing an automated inventory control system and granting customs authorities access are among the most impactful measures. Businesses must act proactively to meet these requirements, avoid penalties, and secure their certifications to maintain smooth foreign trade operations.

If your company holds VAT, IEPS, or OEA certifications, we recommend paying close attention to these changes and taking the necessary steps to ensure compliance. For expert guidance on implementing these updates, reach out to EO Consulting for specialized advice.

Blvd. Capitán Carlos Camacho Espíritu 725, Prados Agua Azul, 72430 Heroica Puebla de Zaragoza, Pue.

Blvd. Capitán Carlos Camacho Espíritu 725, Prados Agua Azul, 72430 Heroica Puebla de Zaragoza, Pue.